Internal and Board Reporting

On September 12th, our latest Revinar featured a compelling discussion between Marc Friend the CEO of Rapid API and Johannes Hoech the CEO of Premonio. They explored the dynamic topic of Internal and Board Reporting and shared key strategies and insights on how executives can effectively engage their boards to improve communication and decision-making.

Watch this Revinar at this link (most of it, that is – a few minutes of opening pleasantries are missing).

Marc kicked off the Revinar with practical tips on maximizing board member networks. He suggested assigning them “homework,” like making introductions to key contacts, from vendors to pension funds. This simple but effective approach helps leverage board relationships for greater impact.

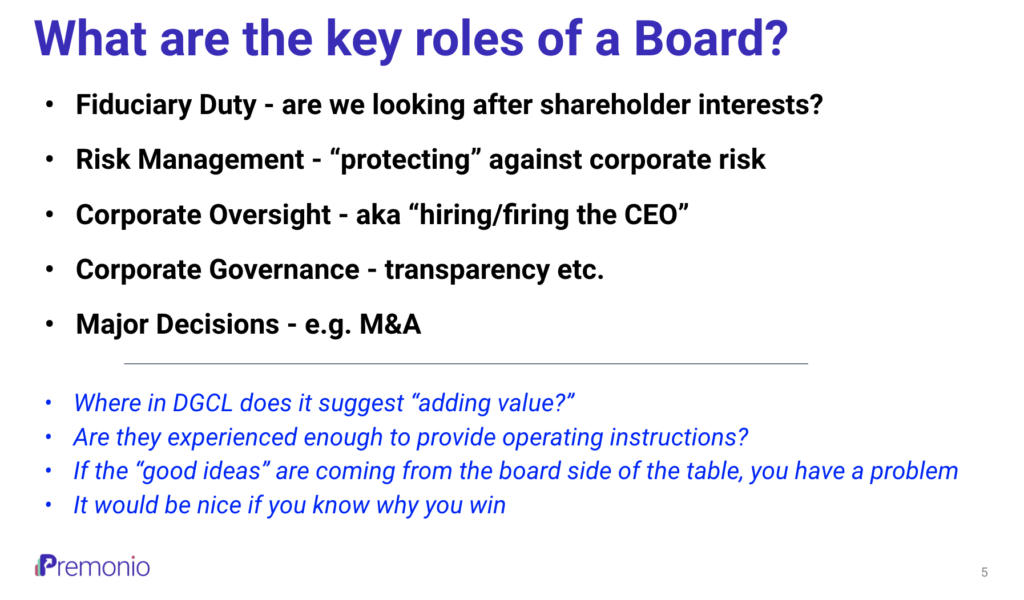

Johannes then elaborated on how board members approach inquiries. Unlike executives, who are immersed in day-to-day operations, board members seek to understand the data and broader challenges. They’re not questioning your abilities but aiming to grasp the context of the business.

Marc continued the conversation and stressed the importance of clarity and objectivity when answering board questions. A clear example is when board members inquire about missed targets — it’s not a personal attack; it’s about understanding the context.

It is essential to focus on cultivating an environment where board members can ask candid questions and executives are comfortable sharing all the details, good or bad. Transparency and openness are key to board-executive solid relationships.

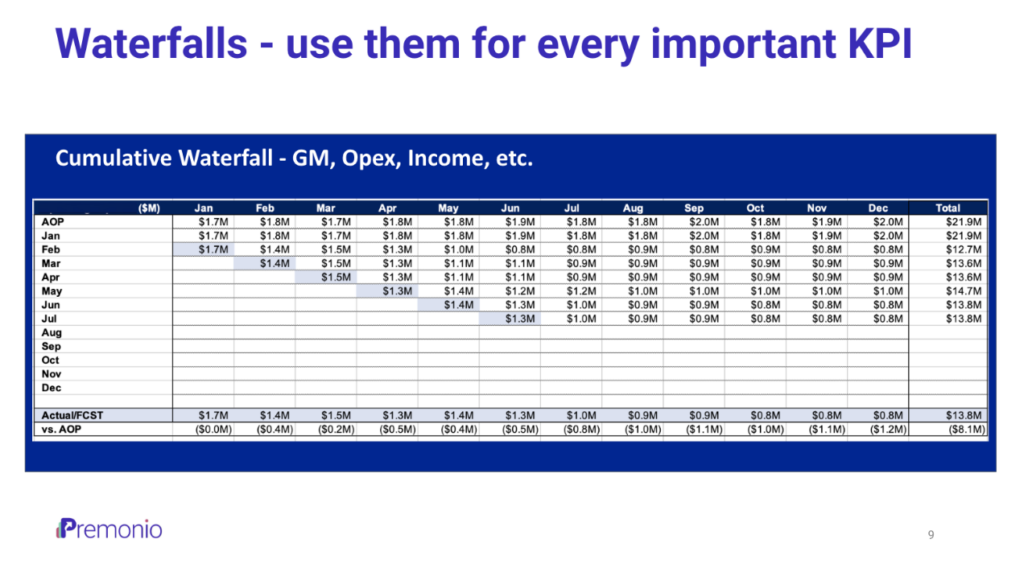

Next Marc shared his recommended format for presenting key metrics (KPIs). He advocates using two main types of reports: one for cumulative balances and another for standalone balances (like cash or pipeline). The idea is to track performance against the annual operating plan (AOP) at each board meeting, updating the actuals each month. This format allows the board to see how forecasts and actuals evolve over time. For example, a board could track how projected operating expenses or revenue changed over the year, ensuring that financial discussions focus on strategy rather than reconciling numbers.

Marc highlighted that using this method prevents confusion about changes in forecasts, removing the need for board members to dig through old decks. It provides transparency and makes key KPIs easy to follow, allowing the focus to shift towards strategy, investments, and product direction.

Johannes and Marc explained a common approach to financial forecasting. Each month, a new row of data is added, reflecting both actual numbers for the previous month and updated forecasts for the remaining months of the year. For instance, by April, the actual figures for January and February are already set, and March’s actuals are added, while forecasts for the rest of the year are revised accordingly. Over time, this results in a diagonal progression of actuals and forecasts across the report.

Example related to cash forecasting. At the start of the year, the company expected to burn $20 million in cash, reducing their cash reserves from $33.6 million to $16 million by year-end. However, by March, the forecast was revised, now predicting $25 million in cash at year-end. This shift reflects a change in their cash burn outlook, particularly impacting the second half of the year.

Next Marc mentioned that he uses a consistent format for tracking KPIs across multiple slides. Each slide contains a graph or spreadsheet for a different KPI that he considers important. These KPIs cover areas such as bookings, revenue, gross margin, operating expenses, net income, cash, pipeline, deal count, and headcount. By maintaining consistency throughout the year, he ensures that these critical metrics are regularly updated and easy to follow. If a new, pressing metric arises, it can be added as needed.

First questions that had come in from the audience during our Revinar was

“What KPIs Does the board care about and which should you never share with them?”

Marc emphasized the importance of transparency with the board, advising not to hide anything and to actively seek their help. He mentioned that while most business metrics should be shared, some internal metrics, like the percentage of OKRs met each quarter or specific sales quotas, may not be useful for the board. These metrics can be hard to interpret or depend on internal strategies, such as how quotas are set. Marc concluded by saying that providing clear, relevant information invites tougher, more constructive questions, which ultimately helps improve the business.

Second question was about the waterfall chart from a CFO in the audience: “How long did it take your board and leadership team to understand the waterfall chart?”

In response to the question Marc explained that it can be overwhelming due to the sheer volume of numbers. He shared that he took a step-by-step approach to help them grasp it. At the start of the year, he provided a full-year waterfall model with disguised data to walk them through how the actuals and forecasts evolve month by month. He noted that it’s not always intuitive, especially for consumer subscription companies, where early planning can lead to discrepancies later in the year due to changes in active users. He emphasized that board members may struggle with these nuances, particularly if they come from different industries than SaaS. Therefore, it’s important to guide them through the details slowly.

Third question was focused on maintaining strategic consistency while engaging with the board. “When sharing information and metrics with the board, how do you prevent sudden shifts in strategy that might arise from board feedback? Specifically, how do you balance staying on course with your strategic direction while still being open to and incorporating valuable suggestions from the board?”

Marc advised against making decisions or changing strategy during board meetings. He suggested acknowledging board questions or ideas, then following up with a detailed analysis later. He emphasized that the board should support, not direct, operational decisions, and that strategic shifts should be discussed thoroughly before being implemented.

Last question came from one of the attendees, who was interested in understanding the psychological approach Marc uses in his interactions with the board. “Could you elaborate more on the psychological strategies you apply to manage board dynamics and maintain strategic consistency?”

Marc emphasized that CEOs should avoid changing strategy based on board feedback received outside meetings. Instead, he recommends handling such suggestions with thorough analysis. He noted that board members, often more risk-averse than they appear, should be kept well-informed to build trust. Marc also highlighted the importance of maintaining a clear distinction between advisory roles and operational decisions, stressing that VCs should respect the CEO’s role in running the company.

We are grateful to everyone who attended this “Revinar” and hope these insights were helpful. We would like to invite you to our next Revenue Collective “RevCo” events in the Bay Area, where we can connect and share knowledge.

Next Premonio events:

Oct 11th 10 am to 3 pm – Revenue Collective “RevCO” networking event at Pier 35 in San Francisco, location on the SS Jeremiah O’Brien. We’ll end the day networking up on deck on her fantail watching the Blue Angels do their aerobatics as part of Fleet Week.