Navigating the Tech Slowdown: How CXOs are Turning Challenges into Opportunities

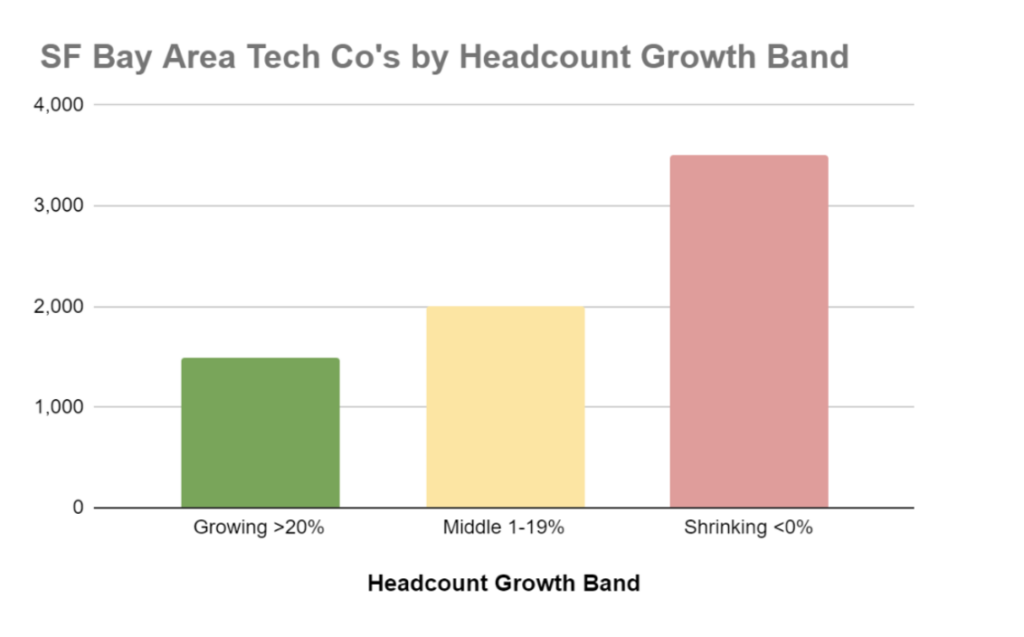

Since growth for many companies in the San Francisco Bay Area tech sector has been slowing after 2022, these firms are facing mounting pressure to adapt. Despite these challenges, this also presents opportunities for those ready to rethink strategies and capitalize on emerging trends. Below are the results of an analysis we did in October 2024 of the San Francisco Bay Area mid-size tech sector.

There are about 7,000 to 8,000 “mid-size” tech companies in the SF Bay Area, with mid-size being defined as somewhere between 11 and 1,000 employees. Of those, over 80% are now grappling with stalled or stalling momentum as enterprise buyers pull back, forcing these vendors to scale down (only firms in the green bar are still growing headcount at over 20% per year).

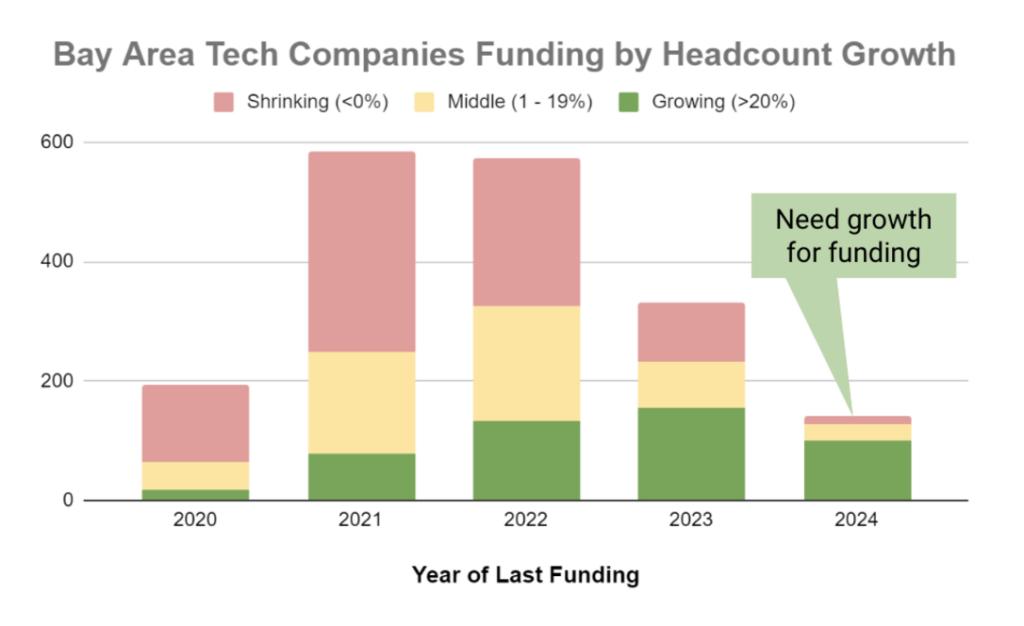

Adding to these pressures, funding has become increasingly selective. Investors are now laser-focused on demonstrable, scalable revenue growth, making it harder for companies to rely on hype or potential alone to secure capital. Today, success hinges less on grand visions but more on delivering tangible as well as measurable results.

As funding is tied closely to demonstrable revenue growth, investors are prioritizing companies that can prove profitability and scalability. Tech firms must provide clear metrics like consistent revenue, optimized CAC / LTV, and realistic growth forecasts to attract capital. Investors are focusing on businesses with efficient operations, strong leadership, and a sharp strategic focus, while speculative ventures or those missing clear financial results struggle to secure funding.

Transparency and accountability are essential, with investors favoring companies that provide regular updates on performance and show an ability to scale consistently. In this cautious environment, results matter more than promises.

Shifts in Corporate Structures

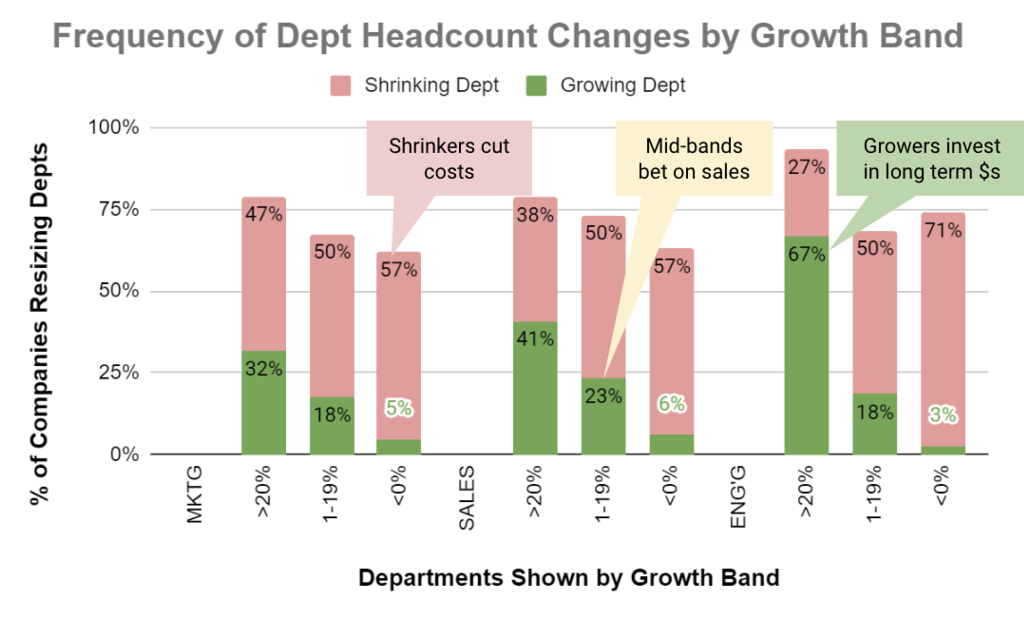

In response to stagnant growth, it is interesting to see how companies are shrinking their departments linked to growth, particularly marketing, sales and engineering. They are seeing cuts as slow-growing companies prioritize cost savings and profitability. This downsizing reflects a broader trend where organizations prioritize efficiency over expansion, necessitating a reevaluation of team structures and roles. A deeper analysis of our sample of mid-size San Francisco Bay Area tech companies tells an interesting story:

This graph contains three groups of three vertical bars each: The right group of three bars shows engineering headcount trends, the middle group shows sales, and the leftmost group of three bars highlights marketing headcount trends. In each group, the leftmost bar shows headcount trends for growing companies, while the rightmost bars show those for shrinking companies. Here is what we found:

- Shrinking Companies (<0% Growth): Companies experiencing negative growth were focused on reducing costs. A large percentage of shrinkage occurred in engineering (71% of companies), and in sales and marketing (57% of companies each), suggesting reductions in short- and long-term revenue-generating activities as shrinking companies were mainly focused on reducing headcount to control expenses over enabling growth.

- Moderate Growth Companies (1-19% Growth): These companies were betting on sales (23% of companies are increasing sales headcount) as a driver of short-term growth, with smaller increases in engineering (18%) and marketing (18%). I.e., moderately growing companies seemed to be focused on expanding selling to drive growth quickly.

- High Growth Companies (>20% Growth): Fast-growing companies appeared to invest heavily in long-term growth, i.e. in engineering (67% of growing companies), as they prioritize product and technology development. Sales (41%) also saw significant growth, indicating an investment in revenue generation. Marketing was expanded by 32% of companies, which was lower headcount growth than for engineering and sales.

C-Level Dynamics

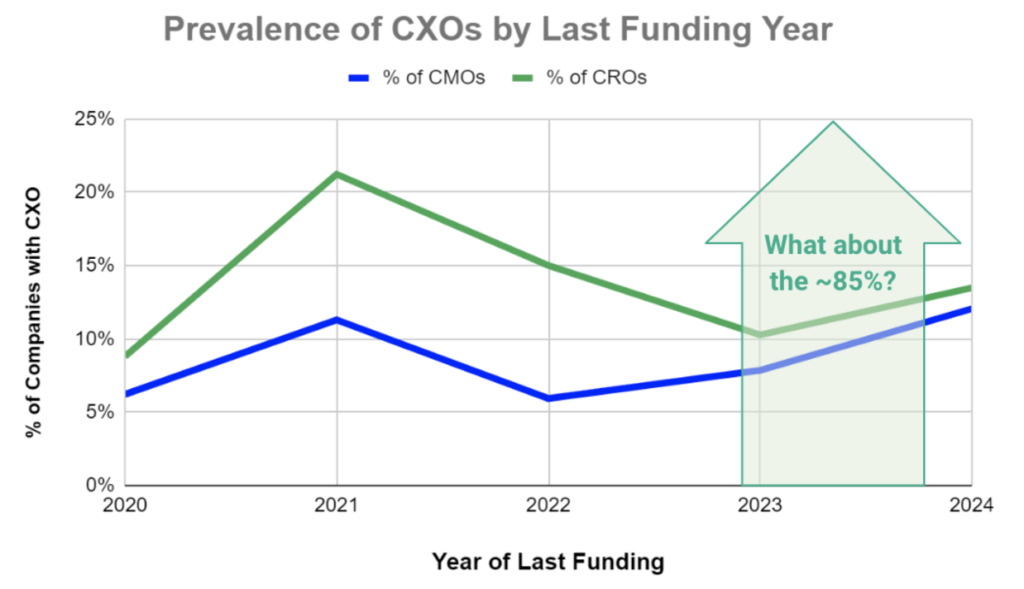

The observable reduction in the number and seniority of marketing roles in mid-size tech companies has implications for their hiring practices and strategic planning. One shift in executive roles is becoming clear with CROs gaining prominence over CMOs, reflecting a growing focus on measurable revenue generation and direct-line-of-sight accountability. Additionally, companies are increasingly recruiting remote CROs to bring in fresh perspectives or to lower the cost of sales leadership compared to the high-priced sales talent available in Silicon Valley.

Meanwhile, the CMO market faces a different challenge – the supply of professionals labeling themselves “CMO” is roughly double the number of companies actually saying they have a CMO on staff. With an oversupply of CMOs, companies are becoming more selective, prioritizing leaders who can directly influence revenue. This surplus should theoretically force CMOs to differentiate themselves in the hopes of them finding a hiring business that can be the right fit for their skills.

This graph shows that most mid-size (11 to 1,000 employees) tech companies in the San Francisco Bay Area currently report not having a CXO. The market is fairly balanced when it comes to CROs; roughly the same number of people say in their LinkedIn profiles that they are employed as CROs as there are companies saying they actually employ a CRO. However, the situation with CMOs is different: The number of people in the SF Bay Area claiming to be a CMO is roughly twice the number of companies saying they’re employing a CMO.

New Opportunities Arising from Market Changes

More growth, spend less: Businesses should focus on scaling smartly—investing in high-return initiatives like data-driven marketing, optimizing customer acquisition costs, and operational efficiency. At the same time, they must keep a close eye on costs, ensuring that every dollar spent contributes directly to measurable growth outcomes.

Ways to cut costs and save more:

- Automation: Companies should automate demand generation. For instance, use tools and services like Leadwave.ai, Dux-Soup to make LinkedIn outreach faster and more effective. Clay.com for personal messaging at scale, and Apollo for automated email campaigns.

- Offshoring: Transfer certain business activities or entire processes to countries with lower operational costs. This can significantly reduce overhead while maintaining service quality.

- AI-Based Approaches: Leverage AI for content creation, social media posts, graphic design. AI tools for marketing are for example: ChatGPT – for context or image creation, Perplexity – to summarize files and create content, Jasper.ai for generating and processing language, or Clay.run for segmented messaging at scale and for low-cost database generation.

- Accountability is in, but data is absent: There’s increased demand for accountability, though most startups and turnaround do not have sufficiently accurate and deep data to back their planning and resource allocation decisions. Analytics without reliable data underlying it is useless, requiring the need to apply alternate techniques to predictably plan growth.

New tools can reinvent sales & marketing: Automation and personalization are now essential for closing deals. They enable teams to connect with leads more effectively. Here are a few AI tools that can significantly impact your lead gen, sales, and marketing:

The Awareness stage of the B2B lead lifecycle:

- Anthropic: It’s an AI safety and research company. It’s experienced across ML, physics, policy, and product. They generate research and create reliable, beneficial AI systems.

Lead generation stage of the B2B lead lifecycle:

- CrystalKnows: uses AI-driven personality insights to personalize communication strategies, providing profiles that suggest the best way to engage with specific individuals based on their communication style.

- Lusha: AI Prospecting Tools that includes an AI email assistant that allows you to do smarter email personalization and faster results.

Lead generation stage and the lead qualification stage of the B2B lead lifecycle:

- Leadwave.ai: provides advanced lead generation capabilities, using AI to analyze market data, identify new leads, and predict customer behavior. It engages leads with personalized messaging and multi-channel outreach. It also prepares warm leads for the sales team.

- Instantly.ai: B2B lead finder delivers a way of finding your business’s perfect buyers by using AI-powered workflows. They hold a database of over 80 million contacts.

Nurturing and engagement of the B2B lead lifecycle:

- Hippo Video: creates personalized videos quickly, easily, and at scale.

- Hemingway AI: helps you to write like you, not a robot. It matches your tone and word choice so rewritten sentences sound like you.

- Canva AI: generates AI images for free.

Consideration and solution research stage of the B2B lead lifecycle:

- Narada.ai: this is a hot “agent-based” AI solution coming out of the AI Lab at UC Berkeley that automates the creation of workflows and activities. For example, create a summary of your meeting packed with action points and finds out details about meeting attendees before the call. Among other things, Narada connects Slack, Calendar, Email, Zoom and OCR. This tool is applied in the decision-making stage of the lead lifecycle.

- Salesforce Einstein: changes how businesses interact with customers using AI in the CRM platform. With its advanced tools, Einstein helps companies make smarter decisions, automate tasks, and offer personalized experiences to many customers.

Virtual and fractional work offers ROI: Utilizing remote and part-time talent can deliver high returns while keeping overhead costs low. By tapping into a global pool of skilled professionals, companies are accessing specialized expertise without the long-term commitments associated with full-time hires. This flexibility allows organizations to scale their workforce according to project demands, ensuring they have the right talent available when needed. For example, while fewer CMOs are employed, many fractional CMOs (“fCMO”) are still finding work.

Moreover, virtual and fractional roles often lead to increased productivity, as employees in these positions tend to have a diverse range of experiences and a strong focus on results. And companies can attract higher caliber talent at lower cost than what they would have been able to previously for full-time roles.

Tightening product-market fit, ICPs, and value propositions offers leverage: Refining product-market fit, ideal customer profiles (ICP), and value propositions are some of the highest-leverage help with which companies can gain a competitive edge and capture new opportunities in the current market. As the advertising and unsolicited demand generation noise level rises, it is increasingly difficult for companies to stand out and get noticed, esp. startups with little or no brand recognition. Knowing exactly who to target with what, super-tight value proposition, and knowing how to tell that story compellingly is more important now than in a long time. Ironically enough, even though marketing bore the brunt of the recent layoffs, those skills are exactly what good marketers should be bringing to bear on the employers / clients.

Back to CMO basics, but sell via data: So, things come full circle and utilizing data allows marketers to effectively segment their audience, customize their messaging, and create personalized experiences that grow engagement and conversion rates. By analyzing customer journeys, companies can pinpoint what works and make real-time tweaks to improve campaign effectiveness. Using analytics tools promotes a culture of continuous improvement.

As the tech sector in the San Francisco Bay Area faces a slowing market place, adaptability is important to succeed. While companies grapple with challenges like reduced funding and departmental shrinkage, these obstacles also create opportunities for innovation. And by focusing on new go-to-market technologies, usefully data-driven decision-making, refining their product-market fit, and leveraging virtual talent, organizations can be more efficient and align with the new expectations of investors and customers.

For more insights from our last RevCO meeting please check out Doug Skinner’s blog or Andreas Mueller’s blog about our October 11, 2024 Revenue Collective “RevCO” event.

Next Premonio events:

“Revinar” with White Glove AI on Dec 05, 2024 at 9 AM (PT) on topic – Turning Your CFO into an AI Advocate: A Realistic Approach to AI Investment