Every board meeting is a strategic moment: a chance to reinforce credibility, align on plan adjustments, and secure the board’s confidence to keep growing.

Equally important, these meetings offer a rare opportunity to distill complex performance data into a clear, compelling narrative about the company’s growth. Board members are not immersed in the day-to-day operations. So it’s imperative to equip them with structured, transparent data and the contextual depth required to make informed decisions and provide meaningful guidance.

What are the key roles of a Board:

- Fiduciary Duty – look after stakeholders interest

- Risk Management – “protect” against corporate risk

- Corporate Oversight – aka “hiring/firing the CEO”

- Corporate Governance – transparency etc.

- Major Decisions – e.g. M&A

When done right, board meetings:

- Clarify priorities across leadership and board members

- Reinforce alignment on strategy, milestones, and challenges

- Protect the company from corporate risk

- Safeguard stakeholder interests

- Establish accountability by tying KPIs to key initiatives

- Strengthen governance through transparency and mutual trust

How important is the CEO’s report to the board?

At its core, the CEO report is a strategic alignment tool. Connecting tactical execution to long-term vision, shaping the narrative, surfacing emerging risks and opportunities, and ensuring the organization moves forward with clarity and purpose.

Demonstrating Credibility

1. Pre-meeting reporting

The CEO should get the data to the board early, and all reports should be written with financials, team and activity KPIs, and explanations of variances between prior plans and new, actual results. Include both wins and problem areas. Boards can handle the truth if it’s framed in context and paired with action.

To help directors focus their reading, begin with a one-page executive summary highlighting five to six key points the CEO wants to mediate. Keep it clear, honest and fact-based. If advocating a position, include counterpoints and brief historical context.

The report itself should support transparency, accountability, and efficient review. CEOs should:

- Distribute it at least 5 days in advance

- Use headings, visuals, and numbered points to guide the reader

- Include a table of contents and glossary

Include top-tier dashboards covering financials, strategy, risk, and CEO performance, featuring intuitive visuals and clear trend data. Directors should never have to guess at variances; the CEO must explain them clearly and take full ownership, even if others present additional detail during the meeting.

2. Visual Clarity

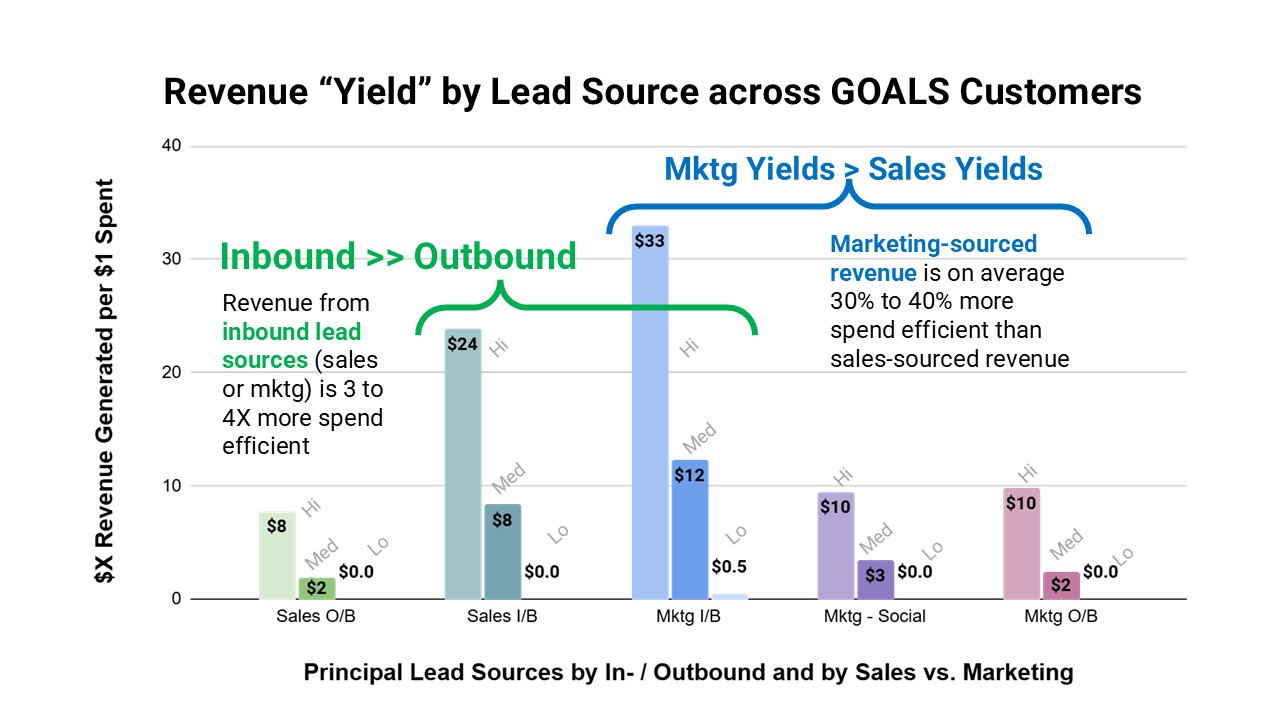

At growth-stage companies, CEO credibility hinges on demonstrating that the revenue and performance milestones promised are being met—or on track to be met—with the full weight of context and corrective strategy behind them. The board doesn’t live in your operating trenches. They’re looking for coherence, transparency, and strategic signal without being bogged down in operational noise.

This is where well-designed visuals like Sankey diagrams are a compelling visual to in one viewing communicate the company’s go-to-market strategy and performance. A Sankey diagram turns complex go-to-market models into a clear, visual narrative that shows how investments flow into outcomes.

It allows the board to instantly grasp budget allocations, strategic priorities, and the tradeoffs being considered. When interactive, these visuals let you simulate different investment scenarios and display updated KPIs in real time, reinforcing that the team isn’t just reporting results, but actively managing and optimizing them. For board members, that’s a strong signal of operational command and strategic accuracy.

Use two main types of reports format for presenting key metrics – KPIs:

- one for cumulative balances

- another for standalone balances (like cash or pipeline).

Cumulative Waterfall:

The idea is to track performance against the annual operating plan (AOP) at each board meeting, updating the actuals each month. This format allows the board to see how forecasts and actuals evolve over time. For example, a board could track how projected operating expenses or revenue changed over the year, ensuring that financial discussions focus on strategy rather than reconciling numbers.

Using this method prevents confusion about changes in forecasts, removing the need for board members to dig through old decks. It provides transparency and makes key KPIs easy to follow, allowing the focus to shift towards strategy, investments, and product direction.

Example:

Each month, a new row of data is added, reflecting both actual numbers for the previous month and updated forecasts for the remaining months of the year. For instance, by April, the actual figures for January and February are already set, and March’s actuals are added, while forecasts for the rest of the year are revised accordingly. Over time, this results in a diagonal progression of actuals and forecasts across the report.

Standalone balances:

Why two sheets? Because cumulative metrics tell the performance story. Standalone metrics show momentum, bottlenecks, and stress points in real time.

Bonus: Include sparklines or mini-charts. Board members scan, not squint.

For more insight about cumulative balances and standalone balances watch our Revinar with more detailed explanations here.

3. Cross-Functional Insight

The CEO should partner with CMO, CFO, CRO, and COO to deliver a holistic snapshot of the business. It should illustrate how each function is contributing or where adjustments may be needed to hit the revenue target.

The metrics the CEO chooses should be directly tied to the company’s strategic goals. These performance indicators can include financial benchmarks, operational indicators, and relevant sales and marketing insights. The CEO’s responsibility is to define the standards and frameworks that enable effective leadership. That includes collaborating with your executive team and the individuals accountable for data and reporting to craft the right KPIs—ones that offer a clear pulse on the organization’s performance and long-term viability.

4. Transparency and Accountability

Be honest about the gaps. But more importantly, be clear on the actions being taken.

- Show the variance

- Explain what went wrong

- Share the plan to fix it

- Assign ownership

- Include a timeline

Boards can handle problems. What they don’t like is surprises.

Final Thought

The growth ideas and the plan should be coming from the CEO’s side of the table. It’s not enough to react; you have to lead the conversation. And just as importantly, you need to know why you’re winning.

So CEOs: if board meeting prep isn’t already a critical item on your calendar—make it one. Because how you show up in that room can define how far your company is allowed to go.